Starting January 2020, the maximum loan limit will be $1,500,000 across the country (no longer State or County specific). *Borrowers with partial VA Eligibility will want to review the amount they can purchase with no money down with a licensed lender*

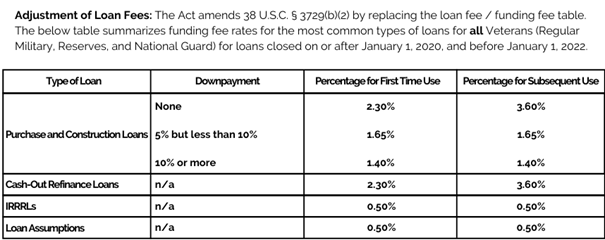

What does this mean? The Funding Fee amounts for VA Purchase and Refinance transactions will increase for loans closing on or after January 1, 2020. The table below outlines these changes:

This is a great opportunity for our Veterans to purchase with no money down without county to county loan amount caps!

Virginia, Maryland, and Washington DC have considerably high veteran populations, both in terms of percentage and sheer number. That said, condominium boards and HOAs are wise to seek approval from Veterans Affairs (VA) for units to be purchased using VA home loans, lest they miss out on a huge number of potential buyers. The District of Columbia hosts hundreds of VA Approved Condos, let alone Maryland and Virginia.

To gain VA approval, a condominium (aka Planned Unit Development or Common Interest Community) must be at least 50% owner-occupied and have at least 85% of its owners current on association dues. New condo developments must be at least 75% sold before they can be approved.

Capital Park Team’s website (cparke.com) is home to one of the few comprehensive databases of VA Approved Condos in the DMV. Best of all, it’s connected to the site’s advanced search tool, allowing you to view any property listings that are approved for VA home loans.

Among the notable benefits provided to veterans in the G.I. Bill signed by President Franklin Delano Roosevelt in 1944, was a provision for low-cost mortgages. Since then over 20 million such loans have been provided.

If you have any questions regarding these changes please contact us below and an a member from our team will be in touch shortly.