New Listing: 1625 15th St. NW #2

Posted by Ben Puchalski on

MLS #: DC10048760 |

Price: $499,000 |

Bedrooms: 1 |

Bathrooms: 1 |

Square Footage: 768 |

Style: Traditional |

Walk Score: 98 |

Open House: Sunday 9/10, 1-3pm |

VIEW LISTING

Classic style meets modern convenience! This newly renovated condo has two exposures, a private entrance and secured patio! The open layout invites an abundance of natural light throughout the entire home. New custom kitchen features granite countertops, stainless appliances, Bosch fridge and separate wine cooler for entertaining. Brand new flooring throughout the entire home. Even the water heater, washer / dryer and recessed lighting are brand new!

…

1288 Views, 0 Comments

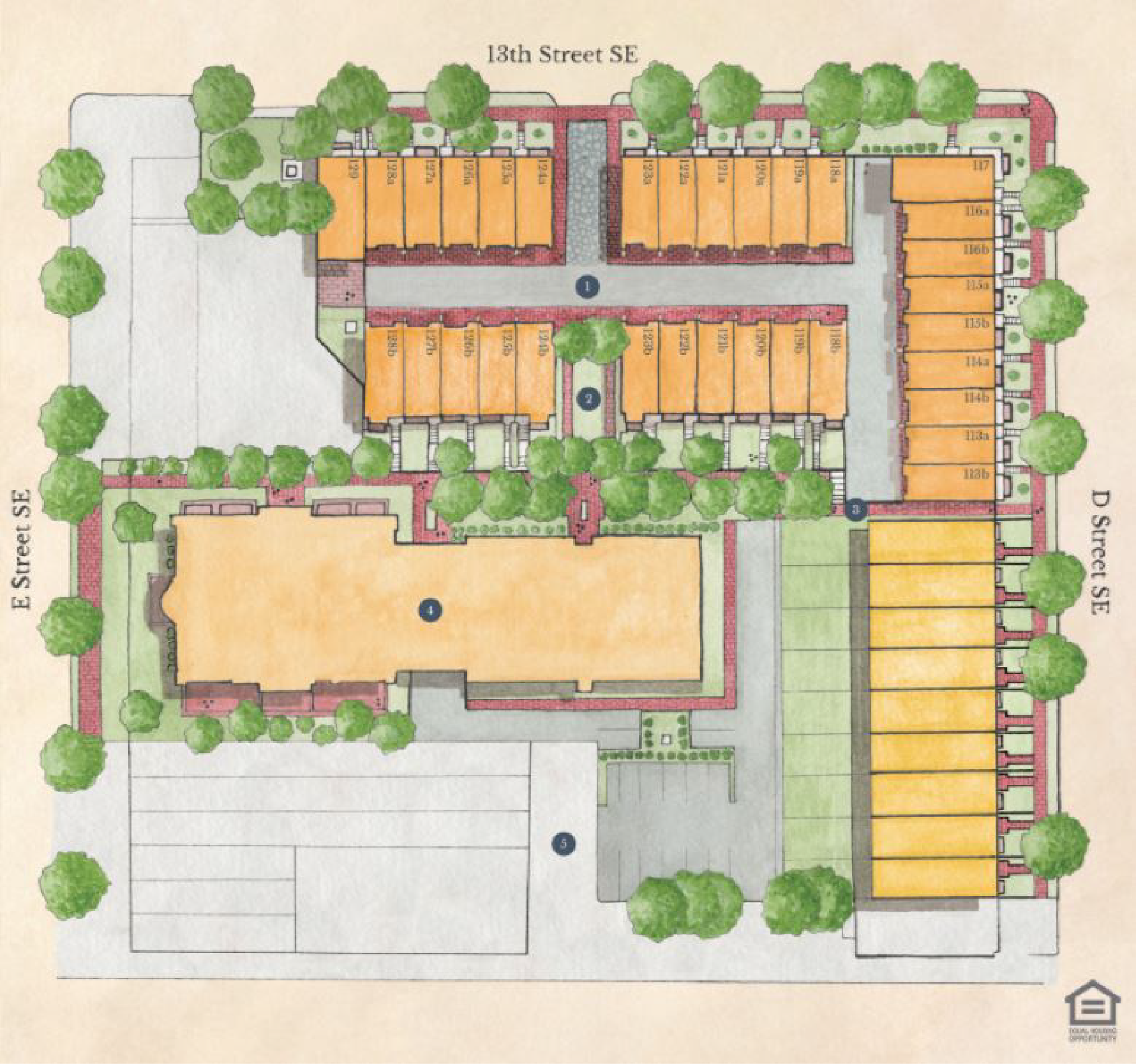

Site Plans

Buchanan Townhomes

Buchanan School

Living Room

Bedroom

Rooftop Deck

Site Plans

Buchanan Townhomes

Buchanan School

Living Room

Bedroom

Rooftop Deck

An overview of title insurance when it comes to owning a home.

An overview of title insurance when it comes to owning a home.